10102 Capital - quarterly #2

Down pre-merge and up again

The quick view

September 2022: + 10.35%

AUM: 141.5 ETH

NAV: 1.09 (ETH / Share)

Other metrics:

Strategy

This quarter was dominated by “the merge” on the crypto end and the inflation numbers on the macro economy one, generating a fair degree of volatility.

As expected ETH the asset remained really strong leading up to the merge event, and weakened rapidly afterwards. In other words, most assets would lose value against ETH before September 15, and would regain their fair share after that time.

Thus we deployed more ETH as the performance was going down, to boost the likely rebound post-merge, taking this opportunity to reinforce some of our positions.

This is what was reflected in the following tweet while our confidence in the high level sequence of events was clear - and indeed in the span of a few weeks, the NAV rebounded from as low as 0.95 to 1.09 at the time of this writing.

Ethereum Naming Service is the new trend

ENS is our best performer this quarter again and here are good metrics to understand why.

Enzyme Finance

A good thread on their tokenomics below, long story short: it looks very promising and as long as the AUM within the entire Enzyme Finance ecosystem keeps growing, its token $MLN should appreciate accordingly. That growth potential is not priced in and we think this is one of the most undervalued asset there is.

Immutable X

Partnerships keep coming along, and more importantly, game titles with large user base. Some of the latest below.

What’s more, the tokenomics of $IMX just received an upgrade based on the following announcements.

It seems we backed builders/protocols that are fundamentally transcending the bear market so far. Let it be our satisfaction, a “value-add” support satisfaction in itself, regardless of their current prices.

Investment updates

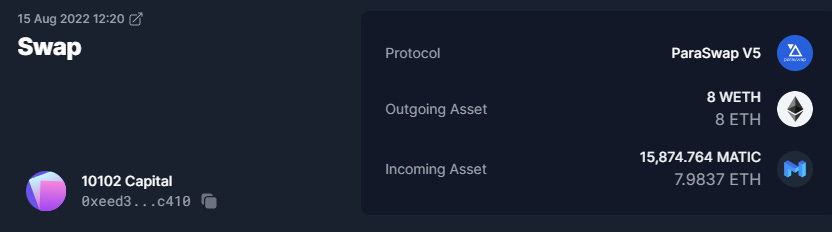

Polygon $MATIC was always going to be part of our portfolio. Their development team is top tier, and their marketing strategy is arguably one of the best in the space.

Just take their latest partnership as a figure - operating the Starbucks rewards program.

Polygon is now about 9% of the portfolio. More below.

New Investor

More Chainlink

Bookmarks

Not an investor yet?

Even though the NAV is now above the initial 1 (that is 1 ETH per share), most of the actual growth is likely to come between now and the next few years. Here is how you can get more familiar with us or be a part of it:

Dashboard (select ETH on the upper right for proper benchmark numbers).

Request of documents (subscription* via DocuSign) or email info@10102.io.

* US accredited investors only.