10102 Capital - quarterly #1

Q2 2022 Report. Special long edition for our 1st quarter.

This is it. The end of 10102 Capital's first quarter. We aimed to experiment with the latest version of the Enzyme Finance protocol and deploy the initial allocations. Result?

As a reminder, the new fund 10102 Capital was officially announced on the brand new twitter account on February 22, 2022. While purposely remaining low key, the manager and another smart investor took a leap of faith right away and trading started on April 1st, at the very beginning of a calendar second quarter.

Accumulating ETH via fundamental positions

The benchmark is Ethereum, which means that performance fees are only executed when the fund outperforms ETH rather than USD. That is because in our book, assets such as Bitcoin and Ethereum will always outperform USD in the long run and therefore it is not sufficient to ‘just’ do that. We want to beat the king of smart contracts itself, ETH. In other words, we want you to have more ETH as time goes on while remaining fully invested in the crypto space (>75% of the portfolio at all times). This fund is for the core believers, the fundamentalists, and the Ethereum hodlers.

The quick view

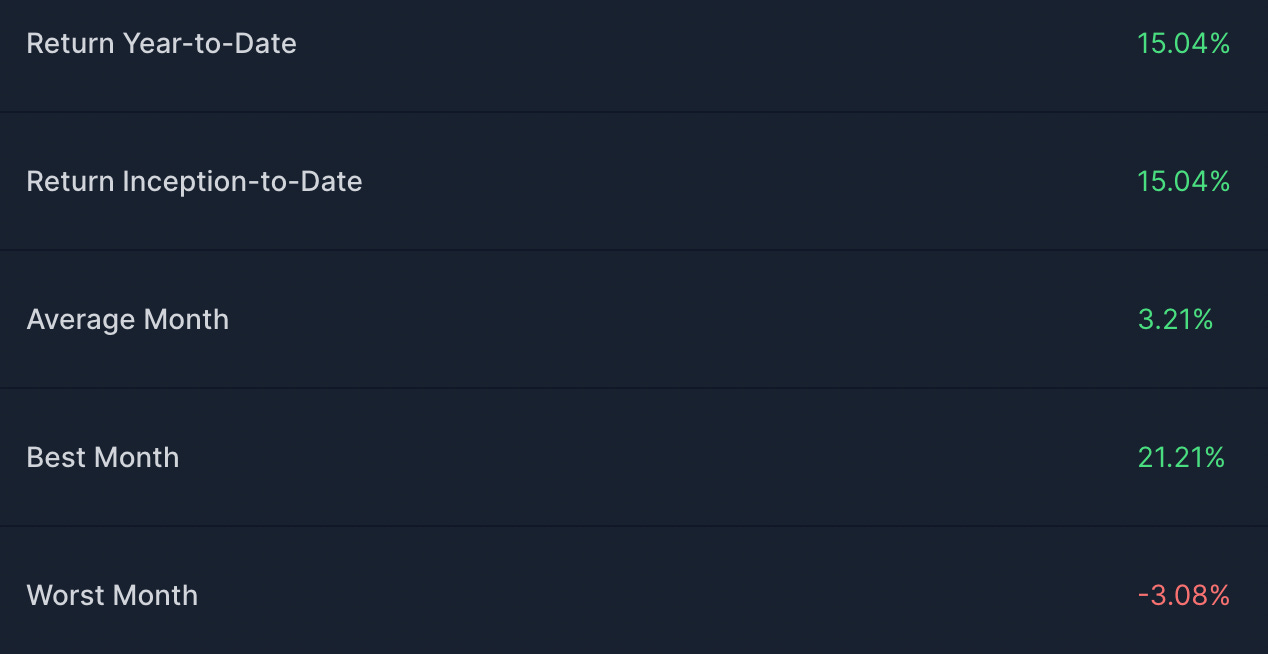

June: +21.21%

(we love Bitcoin and numbers, ending June with +21.21% feels really special).

YTD: +15.04%

Strategy

The high level strategy of this fund is to invest on the fundamentals, or more precisely, the fundamentals of tomorrow. What do we mean by that?

Once again we didn’t create a fully US compliant vehicle to invest just on blue ships that are already popular. The real focus here is to envision what the world will ideally look like in the next 5 to 25 years, and invest on all the necessary pieces of that outcome. Not only we want to support that outcome with our capital, but we want to build the puzzle that will bring us there. Vision is the keyword and that’s what comes after the basics of today. After 101 comes 102. The fundamentals of tomorrow.

Another aspect of the strategy is to stay keen on the latest DeFi developments and leverage the yield opportunities that have been proven to be safe. Having experienced DeFi from its very beginning and followed it through all along, the manager is well situated to take on the opportunities relevant to the portfolio.

Initial Investments

Here are our main investments for this initial quarter with brief comments.

Immutable X (IMX) - probably one of the most active team out there, building and expanding partnerships left and right for being the rails of web3 gaming. They have ultra solid technology built on top of StarkWare with close to 100% uptime, low fees and high scalability layer 2. They are building infrastructure to support multi level layers and the essential cross interoperability between them to make the gaming assets and applications actually useful. Staking of the token IMX is actually launching today. Lots of positive signs all around. Investment announcement here.

Balancer (BAL) - has never been hacked and insures a useful financial functionality, that of automatically balancing pools of two or more assets with configurable fixed proportions. Automated balancing pools are used by many types of applications such as funds, market makers, exchanges, strategists or even issuers (via LBPs). Recently Balancer has launched its new tokenomics with veBAL, similar to Curve and Convex paradigms. More of what this means on our tweet. We expect this asset to perform very well especially when the market rebounds. Meanwhile we actually invested in aBAL which is Balancer deposited tokens on Aave for yield production, about +2% per year.

Ethereum Name Service (ENS) - we invested in ENS right at the end of their airdrop and before all the metrics exploded. Its price has been steady but with a total marketcap of less than $900M, there is a lot of room to growth for such an important piece of Ethereum infrastructure. By far being the most widespread domain system of all, ENS acts as an identity foundation for Ethereum accounts. For example instead of writing down 0x5fC3aFaeeF0fF1149cee3bd80C1B20DE629dF880, you can simply send me tips on my personal public wallet: 749.eth :). It is superior to the .com system in many ways but it would take a whole dedicated post to explain further. What is more important in regards to the fund is that the token ENS is actually a governance right to a very healthy DAO, accumulating growing revenues month over month thanks to the numerous registrations. Subdomains and rentals are coming as well so stay tuned, ENS growth is just getting started.

Enzyme Finance (MLN) - it made sense that our firs investment was gonna be on the protocol we use for our own fund - the suite of smart contracts specialized in asset management. The timing was specifically right since the latest tokenomics just had taken effect - the protocol fees for each vault (fund) would buy and burn MLN, essentially acting as a sort of administrator + custodian business model. At first though the bear trend affected this one more than the other allocations, but it recently reached solid resistance before slightly moving up again. After what happened to Celsius and AC3, it is just a matter of time before the institutions realize the immense value of running AUM (Assets Under Management) on fully trustless and transparent rails. MLN’s time will come and we are here to accumulate and backup its values in the meantime. That’s how we play our part and rewarded, we shall be.

Other

Finally as you can see in the charts and due to the macro economy uncertainties, we started to hedge the overall risk relative to Ethereum with allocations to Bitcoin, Chainlink, and USDC all having more or less possibilities to decorrelate from ETH. The USDC is likely going to flow back to a fundamental crypto asset shortly as we find a new bottom, and Chainlink is there as being oversold during the crash in our opinion yet still playing a fundamental role in most of EVM based decentralized applications today, its universe getting bigger than that of Ethereum. Bitcoin is well… Bitcoin (or more on our actual PoV in another post).

Next quarterly reports

There is too much text to my taste here but as being a first report I wanted to set out the context and some of the reasoning on how we got started.

In fact this is a very condensed form of reasoning but I would be happy to personally go into much more granular details with any one of you if interested.

Some of that will continue to be posted on the official twitter account in addition to private based conversations. More importantly, the trading and portfolio data is always available online and up to date 24/7.

For those reasons the next quarterly reports are going to simply capture the portfolio state and monthly performances - numbers and important events, if any.

Not an investor yet?

Do not worry, even though the NAV is now above the initial 1 (that is 1 ETH per share), most of the actual growth is likely to come between now and the next few years. Here is how you can get more familiar with us or be a part of it:

Dashboard (select ETH on the upper right for proper benchmark numbers).

Request of documents (subscription* via DocuSign) or email kyc@avantgarde.finance & cc info@10102.io.

* US accredited investors only.

Gift

Investors please contact me and claim your special 10102 t-shirt.